News

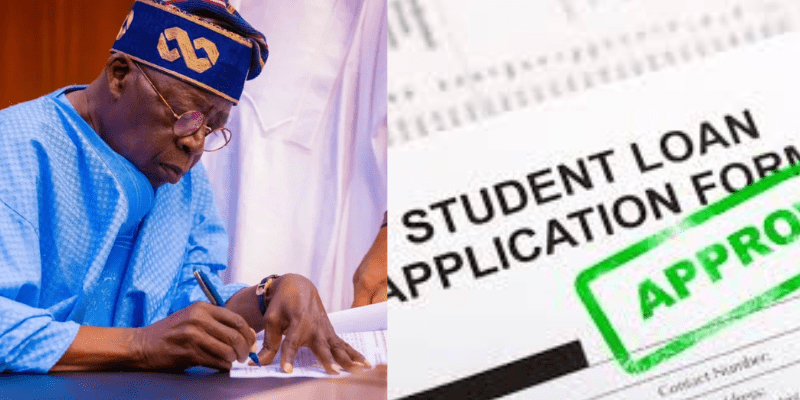

NELFUND Postpones Student Loan Application

The Nigerian Education Loan Fund Management (NELFUND) has officially declared a two-week extension of the student loan application period for state institutions.

This delay is a result of insufficient data submissions, as stated by the agency in Abuja.

NELFUND emphasized that the postponement was prompted by the inability of numerous state-owned institutions to provide the necessary student information and fee details to the NELFUND Student Verification System.

“To date, only a limited number of state-owned institutions have successfully completed the data submission process. These include 20 state universities out of 48, 12 state colleges out of 54, and 2 state polytechnics out of 49.

“While we acknowledge the efforts of these institutions, the failure to submit data from the remaining state institutions poses significant challenges to ensuring a seamless and accurate verification process for student loan applicants.

“The application window, initially set to open on June 25, 2024, will now commence on July 10, 2024,” NELFUND announced.

The organization noted that the deadline extension will give more time for state organizations to meet the data reporting standards and make sure their students are eligible for the Federal Government’s student loan program.

Don’t miss out on any real-time information. Join our WhatsApp group to stay updated.

To make the application process smoother and without mistakes, it’s vital that every state organization submit all the required information accurately.

This requires details like JAMB numbers, matriculation numbers, admission numbers, full names, grade level, colleges or faculties, departments, how long the program takes, tuition fees, and gender for all qualified applicants.

If data is missing or wrong, it could cause delays in applications and possibly lead to these students being disqualified.

The organization encouraged all state organizations to speed up their submission of data and to make sure the information is correct.

It also cautioned that institutions that don’t meet the new deadline could put their students at a disadvantage, who rely on these loans for their education.

![JAMB Releases 2024 Supplementary UTME Results - [See How To Check]](https://nigerianwaves.com/wp-content/uploads/2024/06/JAMB-Result.webp)